A structural shift in Saudi Arabia's residential market sees demand for apartments outpace villas: JLL

· Apartments are in higher demand than villas, with sale prices registering an annual growth of 6% in Riyadh and 17% in Jeddah in Q1 2023

· 50,000 sq. m. of office GLA was delivered in Riyadh and Jeddah, bringing the total existing stock to 4.9 million sq. m. in Riyadh and 1.2 million sq. m. in Jeddah

· Completion of two retail developments in Riyadh contributed to the addition of 84,000 sq. m. of retail space, bringing Riyadh’s total stock to 3.4 million sq. m.

· The government’s recent launch of Riyadh Air and new transit visa service expected to boost the Kingdom’s hospitality sector

· Apartments are in higher demand than villas, with sale prices registering an annual growth of 6% in Riyadh and 17% in Jeddah in Q1 2023

· 50,000 sq. m. of office GLA was delivered in Riyadh and Jeddah, bringing the total existing stock to 4.9 million sq. m. in Riyadh and 1.2 million sq. m. in Jeddah

· Completion of two retail developments in Riyadh contributed to the addition of 84,000 sq. m. of retail space, bringing Riyadh’s total stock to 3.4 million sq. m.

· The government’s recent launch of Riyadh Air and new transit visa service expected to boost the Kingdom’s hospitality sector

الأربعاء - 19 أبريل 2023

Wed - 19 Apr 2023

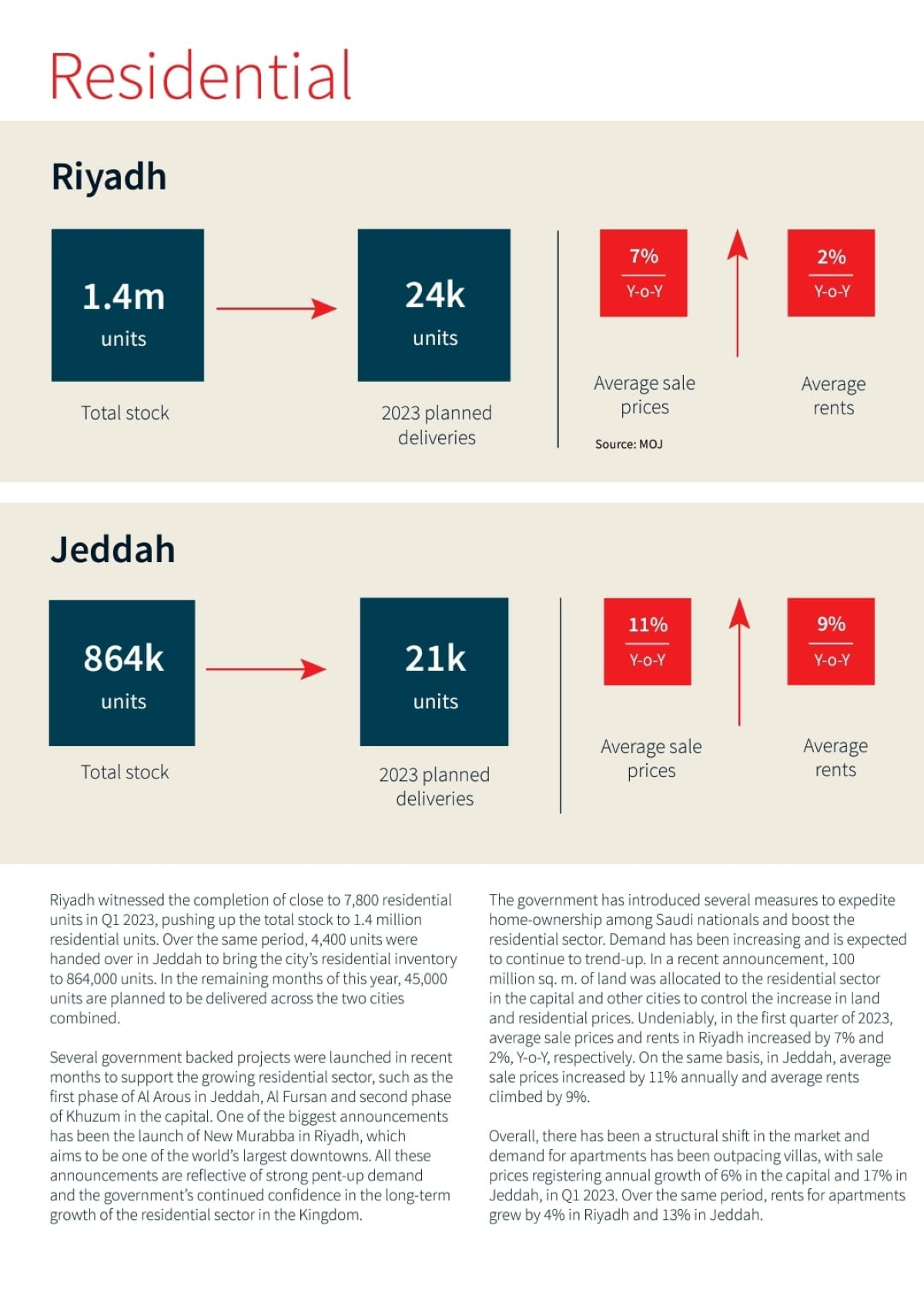

A structural shift in the residential market has seen the demand for apartments outpacing villas, with sale prices recording an annual growth of 6% in Riyadh and 17% in Jeddah, according to JLL’s KSA Real Estate Market Overview Report for Q1 2023. During this period, rents for apartments grew by 4% in Riyadh and 13% in Jeddah.

The positive momentum in residential performance has been driven by the government’s efforts to expedite homeownership among Saudi nationals, an influx of expatriates, and relocating Saudi nationals. The positive drive is being supported by the launch of several projects including the first phase of Al Arous in Jeddah, as well as Al Fursan, the second phase of Khuzum and New Murabba in Riyadh. This reflects the strong pent-up demand and the government’s continued confidence in the long-term growth of the residential sector in the Kingdom.

In the first quarter of this year, Riyadh witnessed the completion of close to 7,800 residential units, whereas 4,400 units were handed over in Jeddah, bringing the latter’s residential inventory to 864,000 units. Additionally, 45,000 units are planned to be delivered across both cities in the coming months.

“The Kingdom of Saudi Arabia is transforming at a rapid pace with the real estate sector playing a key role in driving Vision 2030,” said Saud Alsulaimani, Country Head, KSA at JLL. “In the first quarter of this year, we have witnessed an upward trajectory across the residential, office, retail, and hospitality sectors as Riyadh and Jeddah continue to welcome an influx of tourists and expats. Furthermore, the launch of Riyadh Air also marks a positive step towards supporting the Kingdom's ambition to become a global destination for transportation, trade, and tourism. In line with Vision 2030, the latest in a slew of government reforms will attract new investment opportunities and contribute to socio-economic growth.”

Robust demand supports Riyadh’s repositioning as the Kingdom’s commercial nerve center

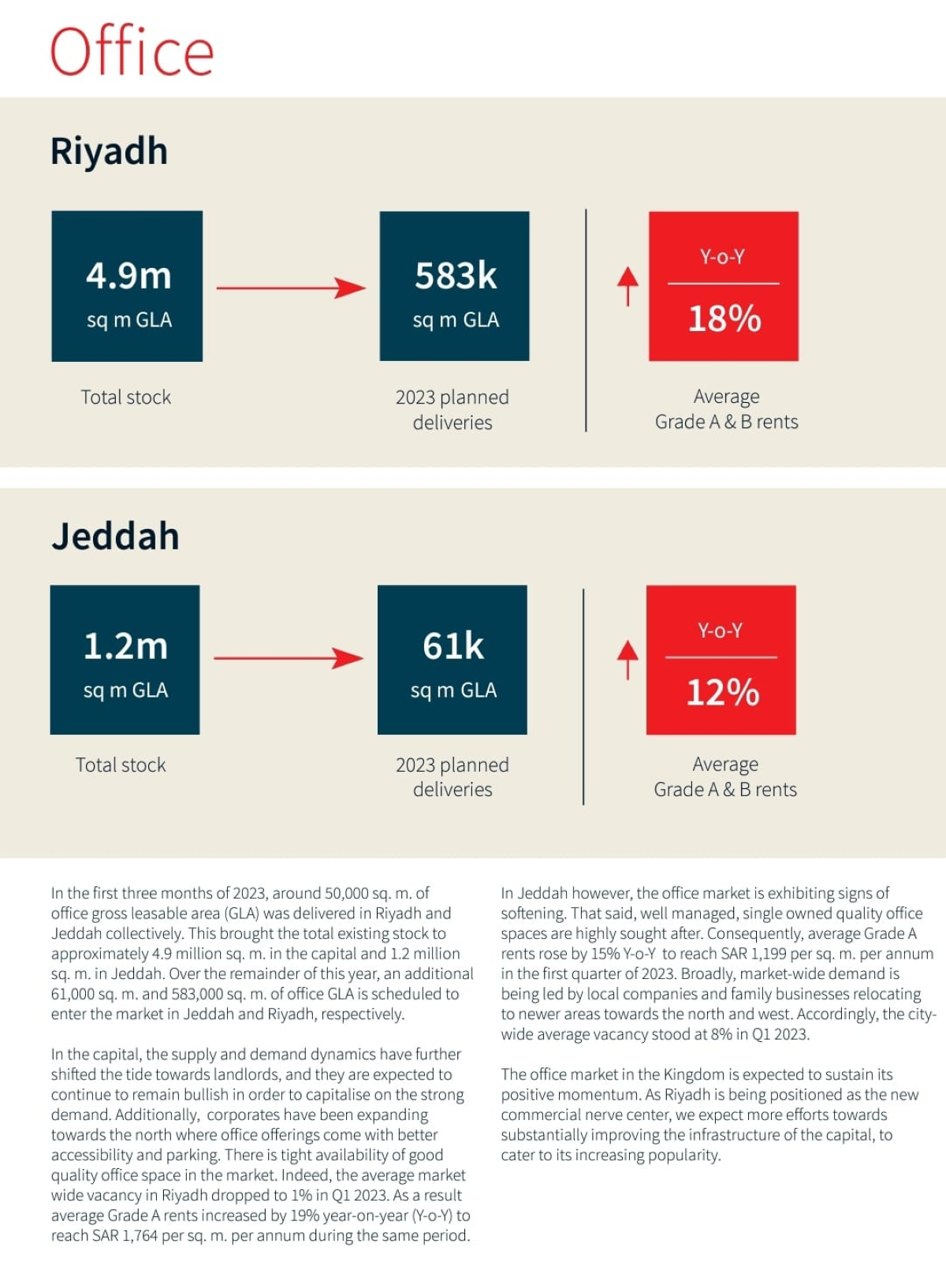

Collectively, Saudi Arabia’s two largest cities – Riyadh and Jeddah – saw 50,000 sq. m. of gross leasable area (GLA) delivered in the first quarter of 2023, demonstrating the positive growth of the Kingdom’s office market. At present, the total existing stock stands at approximately 4.9 million sq. m. in Riyadh and 1.2 million sq. m. in Jeddah. Over the course of the year, an additional 583,000 sq. m. and 61,000 sq. m. of office GLA is scheduled to enter the market in Riyadh and Jeddah, respectively.

The average market-wide vacancy in Riyadh dropped to 1% in the first quarter resulting in average Grade A rents increasing by 19% year-on-year (Y-o-Y) to reach SAR 1,764 per sq. m. per annum in the first quarter. Riyadh’s strong demand for good quality office space amid limited availability has continued to further strengthen landlords negotiating position. Additionally, corporates have been expanding their footprints towards the north where office offerings come with better accessibility and parking.

With Riyadh’s repositioning as a commercial nerve center of the Kingdom well underway, more efforts can be expected towards substantially, improving the infrastructure of Riyadh to cater to its increasing popularity.

On the other hand, the Jeddah office market is exhibiting signs of softening, with the city-wide average vacancy standing at 8% in the first quarter. Nevertheless, well-managed, single-owned quality office spaces continue to remain highly sought after. The demand is being led by local companies and family businesses relocating to newer areas towards the north and west.

Steady increase in retail space in the Kingdom

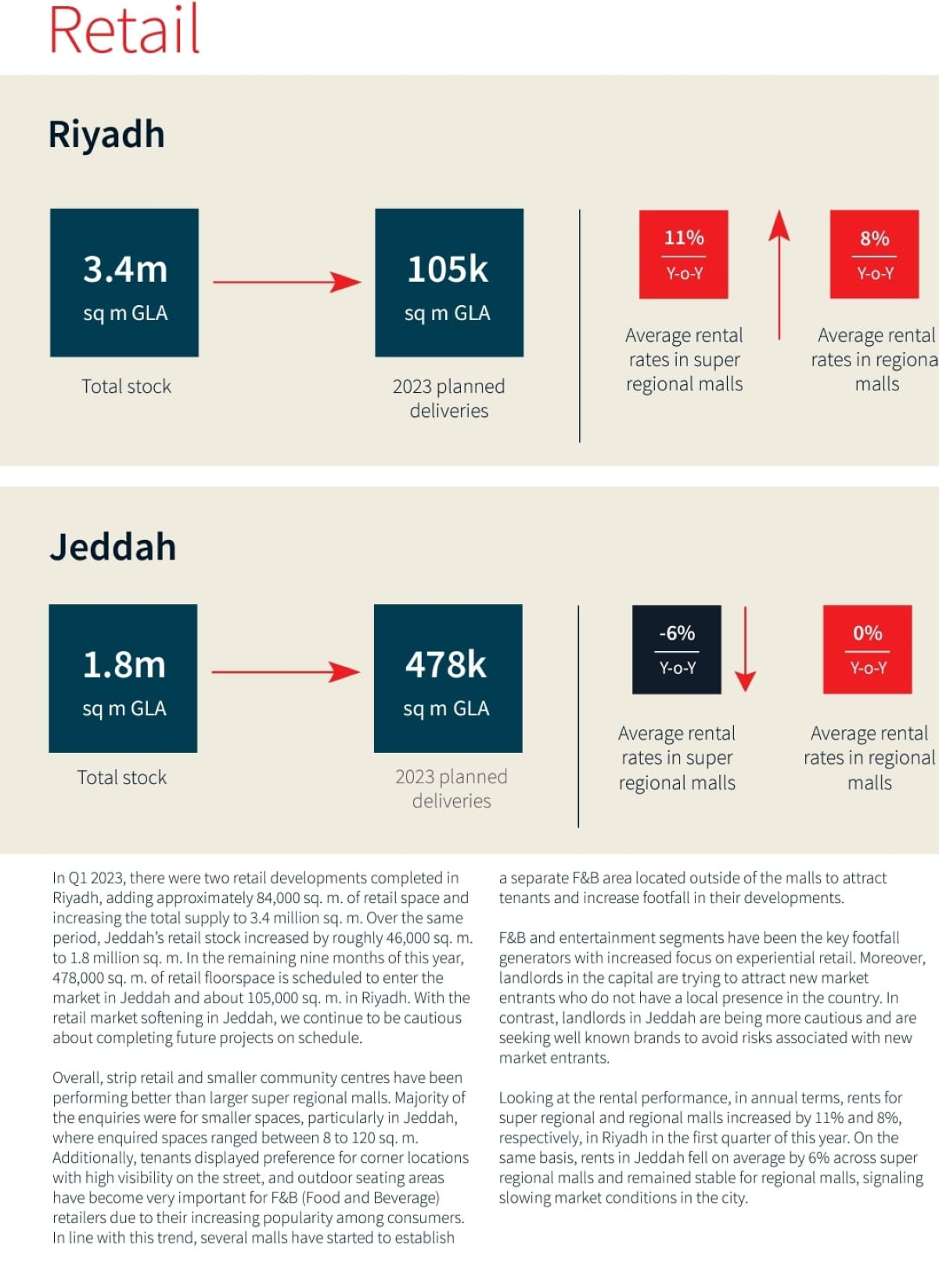

During the first quarter, two retail developments were completed in Riyadh, adding approximately 84,000 sq. m. of retail space in Riyadh, bringing the total stock to 3.4 million sq. m. In Jeddah, the retail stock increased by approximately 46,000 sq. m. to 1.8 million sq. m. Over the remaining nine months of this year, 478,000 sq. m. and 105,000 sq. m. of retail floorspace are expected to enter the market in Jeddah and Riyadh, respectively. That said, with the retail market softening in Jeddah, there is a need to be continually cautious about completing future projects on schedule, signaling slowing market conditions in the city.

Growing in popularity among the younger demographic, strip retail, and smaller community centres have been performing well, showcasing healthy levels of demand in both cities. This is especially true when compared to larger super-regional malls. Majority of the enquiries were for smaller spaces, particularly in Jeddah, where enquired spaces ranged between 8 to 120 sq. m. However, in Riyadh, rents for super regional and regional malls increased by 11% and 8%, respectively, in the first quarter.

Additionally, tenants displayed a preference for corner locations with high visibility on the street, and outdoor seating areas have become very important for F&B (Food and Beverage) retailers due to their increasing popularity among consumers. As a result, several malls have started to establish separate F&B areas located outside of the malls to attract tenants and increase footfall in their developments. F&B and entertainment segments have been the key footfall generators with an increased focus on experiential retail. Moreover, landlords in Riyadh are trying to attract new market entrants who do not have a local presence in the country. In contrast, landlords in Jeddah are being more cautious and are seeking well-known brands to avoid risks associated with new market entrants.

Boost in Hospitality Sector Amid Tourism Initiatives and Expansion

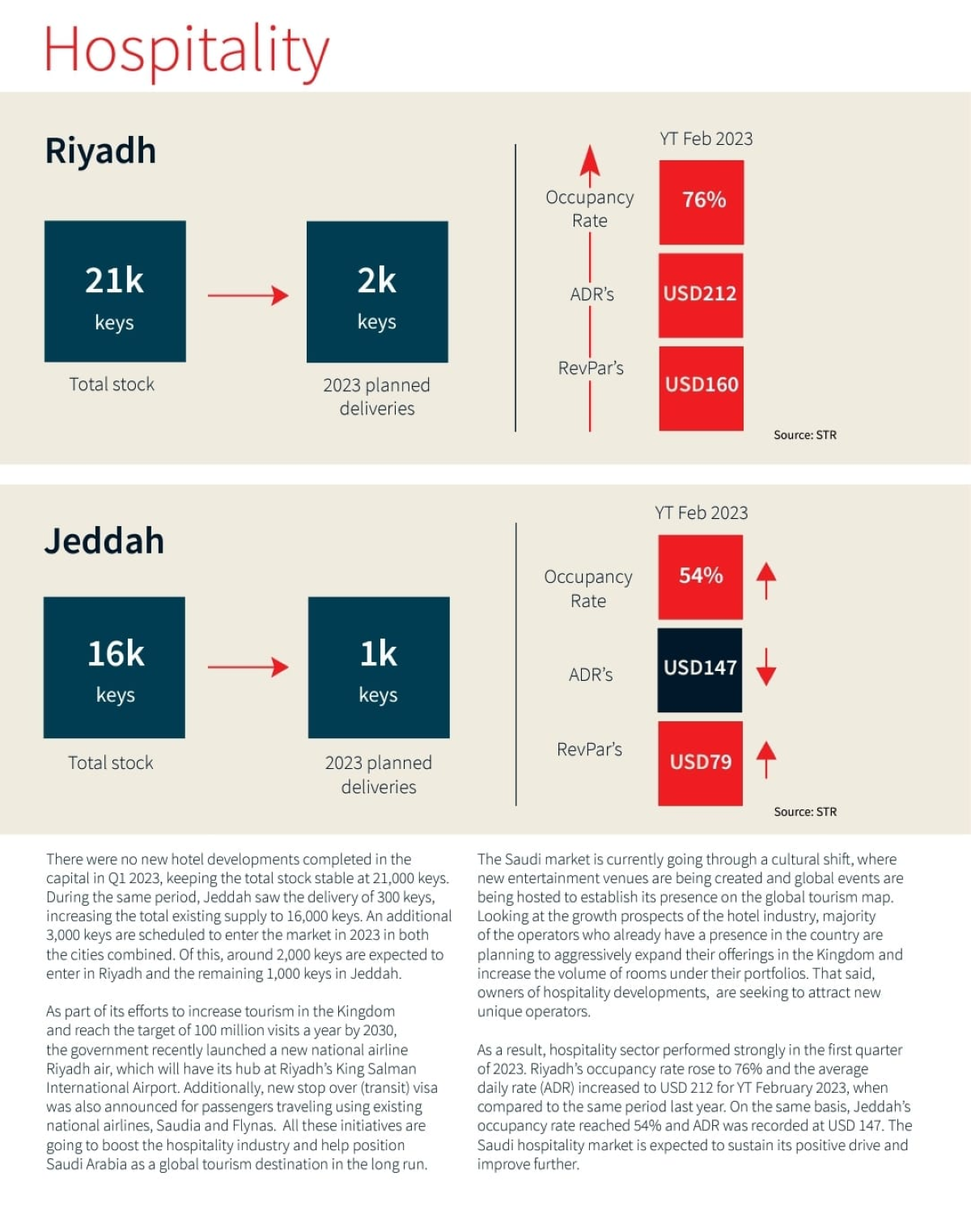

In line with its ambition to become a gateway to the world and a global destination for transportation, trade, and tourism, Saudi Arabia launched a new national carrier, Riyadh Air, and is providing a transit visa service for passengers on stopovers, which is expected to boost the hospitality sector. As a result, majority of the hotel operators who already have a presence in the Kingdom are planning to aggressively expand their offerings and increase the volume of rooms under their portfolios. In addition to this, owners of hospitality developments are also looking to attract new unique operators.

Jeddah saw the delivery of 300 keys in the first quarter, increasing the total existing supply to 16,000 keys, whereas there were no new hotel developments completed in Riyadh. An additional 3,000 keys are scheduled to enter the market in 2023 in both cities; of which 2,000 are expected in Riyadh and the remaining 1,000 in Jeddah.

The hospitality sector saw strong performance in Q1 2023, with Riyadh's occupancy rate reaching 76% and an average daily rate (ADR) of USD 212 for YT February 2023 compared to the previous year. Jeddah's occupancy rate rose to 54% with an ADR of USD 147 during the same period. With ongoing initiatives and expansions, the Saudi hospitality market is expected to sustain its positive momentum and continue to improve.

The positive momentum in residential performance has been driven by the government’s efforts to expedite homeownership among Saudi nationals, an influx of expatriates, and relocating Saudi nationals. The positive drive is being supported by the launch of several projects including the first phase of Al Arous in Jeddah, as well as Al Fursan, the second phase of Khuzum and New Murabba in Riyadh. This reflects the strong pent-up demand and the government’s continued confidence in the long-term growth of the residential sector in the Kingdom.

In the first quarter of this year, Riyadh witnessed the completion of close to 7,800 residential units, whereas 4,400 units were handed over in Jeddah, bringing the latter’s residential inventory to 864,000 units. Additionally, 45,000 units are planned to be delivered across both cities in the coming months.

“The Kingdom of Saudi Arabia is transforming at a rapid pace with the real estate sector playing a key role in driving Vision 2030,” said Saud Alsulaimani, Country Head, KSA at JLL. “In the first quarter of this year, we have witnessed an upward trajectory across the residential, office, retail, and hospitality sectors as Riyadh and Jeddah continue to welcome an influx of tourists and expats. Furthermore, the launch of Riyadh Air also marks a positive step towards supporting the Kingdom's ambition to become a global destination for transportation, trade, and tourism. In line with Vision 2030, the latest in a slew of government reforms will attract new investment opportunities and contribute to socio-economic growth.”

Robust demand supports Riyadh’s repositioning as the Kingdom’s commercial nerve center

Collectively, Saudi Arabia’s two largest cities – Riyadh and Jeddah – saw 50,000 sq. m. of gross leasable area (GLA) delivered in the first quarter of 2023, demonstrating the positive growth of the Kingdom’s office market. At present, the total existing stock stands at approximately 4.9 million sq. m. in Riyadh and 1.2 million sq. m. in Jeddah. Over the course of the year, an additional 583,000 sq. m. and 61,000 sq. m. of office GLA is scheduled to enter the market in Riyadh and Jeddah, respectively.

The average market-wide vacancy in Riyadh dropped to 1% in the first quarter resulting in average Grade A rents increasing by 19% year-on-year (Y-o-Y) to reach SAR 1,764 per sq. m. per annum in the first quarter. Riyadh’s strong demand for good quality office space amid limited availability has continued to further strengthen landlords negotiating position. Additionally, corporates have been expanding their footprints towards the north where office offerings come with better accessibility and parking.

With Riyadh’s repositioning as a commercial nerve center of the Kingdom well underway, more efforts can be expected towards substantially, improving the infrastructure of Riyadh to cater to its increasing popularity.

On the other hand, the Jeddah office market is exhibiting signs of softening, with the city-wide average vacancy standing at 8% in the first quarter. Nevertheless, well-managed, single-owned quality office spaces continue to remain highly sought after. The demand is being led by local companies and family businesses relocating to newer areas towards the north and west.

Steady increase in retail space in the Kingdom

During the first quarter, two retail developments were completed in Riyadh, adding approximately 84,000 sq. m. of retail space in Riyadh, bringing the total stock to 3.4 million sq. m. In Jeddah, the retail stock increased by approximately 46,000 sq. m. to 1.8 million sq. m. Over the remaining nine months of this year, 478,000 sq. m. and 105,000 sq. m. of retail floorspace are expected to enter the market in Jeddah and Riyadh, respectively. That said, with the retail market softening in Jeddah, there is a need to be continually cautious about completing future projects on schedule, signaling slowing market conditions in the city.

Growing in popularity among the younger demographic, strip retail, and smaller community centres have been performing well, showcasing healthy levels of demand in both cities. This is especially true when compared to larger super-regional malls. Majority of the enquiries were for smaller spaces, particularly in Jeddah, where enquired spaces ranged between 8 to 120 sq. m. However, in Riyadh, rents for super regional and regional malls increased by 11% and 8%, respectively, in the first quarter.

Additionally, tenants displayed a preference for corner locations with high visibility on the street, and outdoor seating areas have become very important for F&B (Food and Beverage) retailers due to their increasing popularity among consumers. As a result, several malls have started to establish separate F&B areas located outside of the malls to attract tenants and increase footfall in their developments. F&B and entertainment segments have been the key footfall generators with an increased focus on experiential retail. Moreover, landlords in Riyadh are trying to attract new market entrants who do not have a local presence in the country. In contrast, landlords in Jeddah are being more cautious and are seeking well-known brands to avoid risks associated with new market entrants.

Boost in Hospitality Sector Amid Tourism Initiatives and Expansion

In line with its ambition to become a gateway to the world and a global destination for transportation, trade, and tourism, Saudi Arabia launched a new national carrier, Riyadh Air, and is providing a transit visa service for passengers on stopovers, which is expected to boost the hospitality sector. As a result, majority of the hotel operators who already have a presence in the Kingdom are planning to aggressively expand their offerings and increase the volume of rooms under their portfolios. In addition to this, owners of hospitality developments are also looking to attract new unique operators.

Jeddah saw the delivery of 300 keys in the first quarter, increasing the total existing supply to 16,000 keys, whereas there were no new hotel developments completed in Riyadh. An additional 3,000 keys are scheduled to enter the market in 2023 in both cities; of which 2,000 are expected in Riyadh and the remaining 1,000 in Jeddah.

The hospitality sector saw strong performance in Q1 2023, with Riyadh's occupancy rate reaching 76% and an average daily rate (ADR) of USD 212 for YT February 2023 compared to the previous year. Jeddah's occupancy rate rose to 54% with an ADR of USD 147 during the same period. With ongoing initiatives and expansions, the Saudi hospitality market is expected to sustain its positive momentum and continue to improve.

Related Articles

فيتش ترفع تصنيفها الائتماني للسعودية إلى +Aفيتش ترفع تصنيفها الائتماني للسعودية إلى +A

THE THIRD EDITION OF THE RED SEA FUND OPENS SUBMISSIONS FOR ITS DEVELOPMENT SCHEMETHE THIRD EDITION OF THE RED SEA FUND OPENS SUBMISSIONS FOR ITS DEVELOPMENT SCHEME

فيتش ترفع تصنيف 8 بنوك سعودية من «+ BBB » إلى «-A»فيتش ترفع تصنيف 8 بنوك سعودية من «+ BBB » إلى «-A»

فيتش ترفع تصنيف 8 بنوك سعودية إلى «A-»فيتش ترفع تصنيف 8 بنوك سعودية إلى «A-»